The Signal Everyone Missed

On January 16, 2026, OpenAI announced ads in ChatGPT (OpenAI Blog). Most coverage framed this as logical monetization. I see it differently: this is the moment OpenAI officially entered Google’s arena.

Sam Altman once called advertising in AI “uniquely unsettling” (Yahoo Finance). Now his company is testing ads “at the bottom of answers” for free-tier and Go subscribers, promising they won’t influence responses. The irony is thick. But the strategic implications are thicker.

OpenAI has committed to competing directly on Google’s 25-year core competency. And in doing so, they’ve revealed the structural advantages that make Google’s eventual dominance almost inevitable.

The January 2026 market data already tells the story. According to Similarweb, ChatGPT’s web traffic share dropped from 87% to roughly 65% in twelve months—the steepest decline for any dominant technology platform in recent memory (SecureITWorld). Meanwhile, Google Gemini surged from 5% to over 21%—a 237% increase. The distribution advantage isn’t theoretical anymore. It’s measurable.

Why Google Was “Late”. It Wasn’t Incompetence

Here’s a puzzle nobody asks: Why was Google—with infinite capital, the world’s largest data corpus, and inventors of the transformer architecture—so late to consumer LLMs?

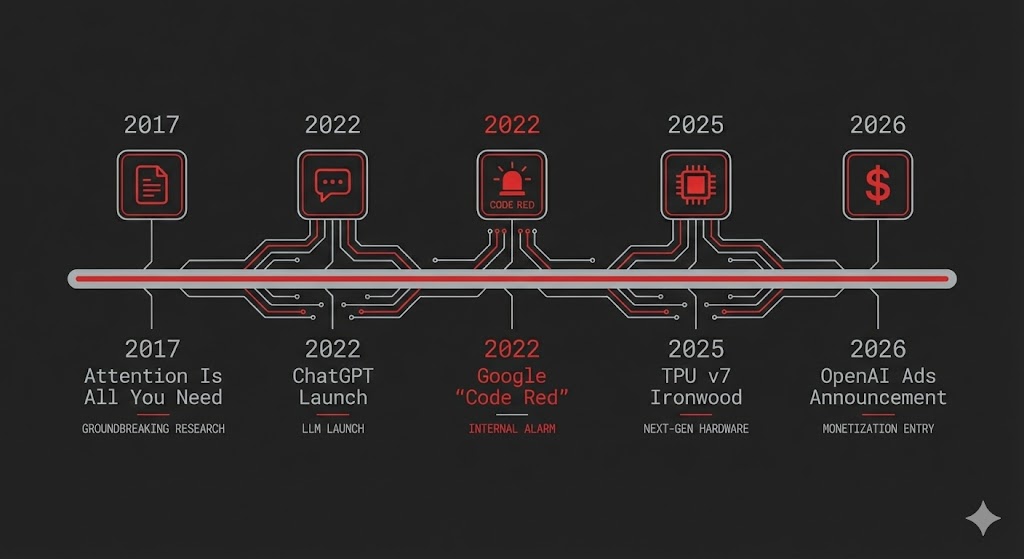

Google published “Attention Is All You Need” in 2017, the foundational paper making modern LLMs possible. They had LaMDA running internally years before ChatGPT launched. They had more training data than any competitor could dream of.

The answer isn’t incompetence. It’s strategy.

THE

LONG

GAME

In 2022, Google Search generated over $160 billion annually—57% of Alphabet’s total revenue. That revenue comes from showing ads when users express commercial intent. LLMs threaten this model at its core. When someone asks ChatGPT “best laptop for video editing,” they get a direct answer. No search results. No ad placements. The entire monetization layer disappears.

Court testimony from Google’s antitrust trial revealed their ad chief stating “the writing is on the wall”—generative AI would eventually cannibalize Search revenue (Fortune). Google wasn’t slow because they couldn’t build an LLM. They were slow because building one meant accelerating destruction of their most profitable business.

This is the textbook innovator’s dilemma (PYMNTS). The same trap that killed Kodak and Blockbuster.

But here’s what’s different: Google survived the dilemma.

The innovator’s dilemma has an expiration date. Once competitors force the market’s hand, the incumbent is freed from paralysis. The old business will be disrupted regardless. The question shifts from “should we disrupt ourselves?” to “how do we win the new paradigm?”

OpenAI’s ad announcement is that expiration date.

The Bifurcation: Google’s Masterstroke

Here’s a strategic move that hasn’t received enough attention: Google is deliberately keeping Gemini ad-free.

While OpenAI is forced to inject ads into its core chat product, Google is running a bifurcated strategy. AI Overviews in Search are being aggressively monetized—ads alongside AI Overviews rose from 3% to 40% through 2025, and Google claims they monetize at the same rate as traditional search results (Search Engine Journal). Meanwhile, the standalone Gemini app remains completely ad-free.

Google’s VP of Global Ads confirmed this explicitly: “There are no ads in the Gemini app and there are no current plans to change that” (Search Engine Land).

Think about what this means. OpenAI must monetize its chat interface—it has no separate cash cow to subsidize the product. Google can subsidize Gemini indefinitely with $200+ billion in annual ad revenue from Search. One analyst put it bluntly: “It is a luxury only Google can afford. They can bleed their competitors by keeping the barrier to entry artificially low” (Aragil).

This is how incumbents with deep pockets win wars of attrition. You don’t outbuild the challenger. You make their business model unsustainable while yours remains intact.

The Silicon Advantage Nobody Appreciates

The AI discourse obsesses over benchmarks. Which model scores highest on MMLU? Who won the latest eval? These metrics generate headlines but obscure what actually determines winners: the cost of inference at scale.

Training is a one-time cost. Inference—running the model to serve queries—scales linearly with usage. At 800 million weekly users having multiple conversations, inference costs reach billions annually before any revenue is generated.

This is where Google has a structural advantage nobody fully appreciates: TPUs.

Google released their first Tensor Processing Unit in 2015—a full decade ago. Unlike NVIDIA’s general-purpose GPUs, TPUs are application-specific chips designed from scratch for neural network operations. On January 27, 2026, the seventh-generation TPU—Ironwood—went generally available for Cloud customers (Google Blog).

The economics are staggering. SemiAnalysis found the all-in total cost of ownership per Ironwood chip is roughly 44% lower than NVIDIA’s GB200 (SemiAnalysis). Ironwood delivers 4x better performance per chip for both training and inference versus the previous generation. At full scale, a single superpod of 9,216 Ironwood chips delivers 42.5 exaflops—more compute than the world’s largest supercomputer (Google Cloud).

And here’s the recursive advantage nobody else can replicate: Google uses AI (AlphaChip) to design each new TPU generation. The hardware accelerates the research that designs better hardware. It’s a flywheel that compounds with every cycle.

But performance is only half the advantage. The bigger factor is supply chain independence.

OpenAI depends entirely on NVIDIA and external cloud providers. When GPU shortages hit, they wait. When NVIDIA raises prices, they pay. Google manufactures their own chips. They control their supply chain. Microsoft started custom chip development in 2019. Google started in 2013. That head start shows in software stack maturity and manufacturing relationships (AI News Hub).

Perhaps the most telling validation came from an unexpected source: Anthropic—Google’s own competitor—committed to purchasing up to 1 million TPU chips in a deal worth tens of billions of dollars (CNBC). Over a gigawatt of capacity, coming online in 2026. When your competitor’s competitor chooses your silicon over the market leader’s GPUs, citing “price-performance and efficiency,” the argument is over.

The Moats Nobody Can Cross

Data: Consider what Google accesses. YouTube: 2 billion monthly users, 500 hours uploaded per minute. Android: 3 billion active devices. Search: 8.5 billion queries daily. Gmail: 1.8 billion users. This isn’t just volume—it’s 20+ years of human digital behavior across every domain, language, and demographic.

OpenAI has ChatGPT conversations and web scrapes. Google has the comprehensive record of human digital life.

Distribution: This was once theoretical. Now I have the numbers.

In January 2025, Gemini held 5% of web traffic among AI chatbots. By January 2026: over 21%. That’s 237% growth in twelve months, driven almost entirely by ecosystem integration—Gemini embedded in Search, Android, Chrome, and Workspace (AI Certs). In the same period, ChatGPT’s growth rate dropped to roughly 6% while Gemini’s MAU grew 30%. Gemini Pro subscriptions are growing 300% year-over-year compared to ChatGPT Plus at 155% (a16z).

OpenAI Just Entered

Google’s Arena;

Here’s Why

That’s a Mistake

OpenAI must convince users to download an app, create an account, change behavior. Google has AI embedded everywhere users already are. AI Overviews alone now reach 2 billion monthly users. The distribution gap isn’t closing. It’s widening.

More importantly, Google captures commercial intent. When someone searches “best laptop under $1500,” they’re often ready to buy. Advertisers pay premium rates for this attention. ChatGPT conversations often lack this commercial context—users seek information, not purchase decisions. Commercial queries triggering AI Overviews doubled from 8% to nearly 19% through 2025 (Search Engine Land). Google is turning AI into a commerce engine. OpenAI is still figuring out where to put the banner.

The Financial Reality

Numbers don’t lie. And OpenAI’s numbers tell a brutal story.

Internal projections show OpenAI expects a $14 billion loss in 2026—roughly triple this year’s losses (Yahoo Finance). The cash burn rate holds steady at 57% of revenue through 2026 and 2027. Cumulative cash burn is now projected at $115 billion through 2029—revised upward by $80 billion from earlier estimates (The Decoder).

The company has committed $1.4 trillion in infrastructure spending over eight years. To fund this, OpenAI needs revenue growth that would rival Google’s own historic trajectory—and they need to achieve it while competing against Google (Carnegie Investment Counsel).

For context: only 5-8% of ChatGPT’s 800 million weekly users pay for a subscription. The remaining 92-95% are a massive cost center. Advertising isn’t a strategic choice for OpenAI. It’s an existential necessity.

Compare this to Anthropic, which expects to drop its burn rate to 9% of revenue by 2027 (Fortune). Or Google, which funds its entire AI operation from $200+ billion in annual ad revenue while maintaining 25%+ operating margins. OpenAI is bringing a credit card to a knife fight—and the card is maxed out.

The Convergence

Here’s my thesis assembled:

The AI industry is converging on advertising-supported consumer services. OpenAI’s announcement makes this explicit. In advertising businesses, unit economics determine winners. The company serving users most cheaply while delivering the best targeting wins.

Google has structural advantages in every factor that matters:

Silicon: Ironwood TPUs deliver 44% lower TCO than NVIDIA’s best. Even competitors like Anthropic chose Google’s chips—committing to 1 million TPUs worth tens of billions.

Data: Twenty years of user behavior across Search, YouTube, Android, and Gmail create an unmatched training and targeting corpus that no amount of funding can recreate.

Distribution: Gemini surged from 5% to 21% market share in one year through ecosystem integration alone. AI Overviews reach 2 billion monthly users. Commercial keyword coverage doubled.

Monetization: Google keeps Gemini ad-free while monetizing AI Overviews at parity with traditional search—a bifurcation strategy only a $200B ad business can afford.

Financial position: Google generates profit while investing. OpenAI projects $14 billion in losses for 2026 alone, with $115 billion in cumulative burn through 2029.

These advantages are structural, not temporary. Competitors cannot catch up on silicon (decade-long development cycles), data (historical data cannot be recreated), distribution (network effects compound), or financial reserves (OpenAI needs to raise capital continuously just to operate).

OpenAI is now competing directly in Google’s core competency with inferior infrastructure economics and a balance sheet that’s hemorrhaging cash. It’s as if a chess prodigy decided victory required challenging Magnus Carlsen to a boxing match—while carrying a mortgage.

The Long Game

Google was late to consumer AI not because they couldn’t build it, but because they understood—better than anyone—what building it meant for their core business. They waited while competitors validated the market, absorbed the innovator’s dilemma in their stock price, and built structural advantages in silicon, data, and distribution.

Now the dilemma is resolved. OpenAI has committed to an ad-supported model. The market has spoken.

The AI war will not be won by the company with the best benchmark scores. It will be won by the company that serves users most cheaply, monetizes most effectively, and reinvests the surplus most productively.

That company is Google. The market just hasn’t fully priced it in yet.

This analysis represents my technical assessment based on publicly available information. I hold no positions in the companies discussed.